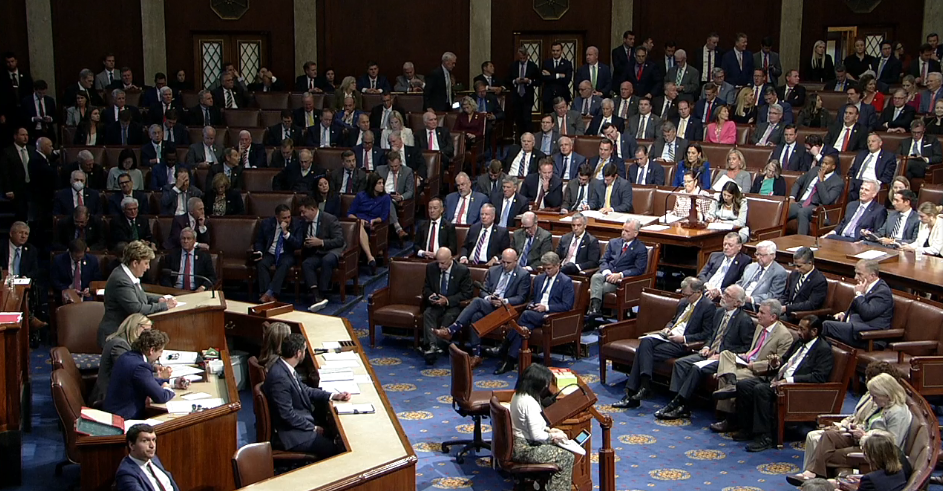

A government shutdown was averted Sept. 30 by former House Speaker Kevin McCarthy with a stopgap deal that will fund federal agencies for 45 more days and passed with broad bipartisan support.

Disagreements between Democrats and Republicans in Congress on how federal funding should be allocated caused the last-minute deal, which narrowly avoided a shutdown. Division following the temporary solution could cause another crisis if the House and Senate fail to fully fund the government by Nov. 17.

“Generally, I think the near-miss government shutdown was sort of a wake up call for the American public and it hits especially different when we realize that we are quickly approaching another extremely pivotal and potentially divisive election year for the nation,” said Andrew Gomes, a sophomore at Suffolk University.

In the event of a shutdown, federal agencies cease nonessential work. Federal employees deemed essential to public safety are still required to work, however, they will not be paid until the shutdown is resolved.

Amongst federal agencies with workers deemed nonessential are multiple programs focused on aid, such as Medicare and Medicaid, Social Security, student loans and Head Start programs.

Social Security, Medicare and Medicaid benefits will continue, but there will be delays in customer service response time due to the furloughing of workers. Funding toward Head Start programs would stop entirely.

About 90% of Department of Education staff will be furloughed in the event of a government shutdown, and while student loan payments will continue, there will be delays for those who require the services of the Department of Education.

Student borrowers planning on adjusting their loan payment plan, those submitting or resubmitting the FAFSA and high-need students may find it more difficult or face long wait times when requesting aid from the department.

However, there are measures put in place by the Department of Education to prolong functionality for as long as possible. A contingency plan, updated Sept. 29, states that programs with mandatory funding, such as Pell Grants and Federal Direct Student Loans, will continue obligations and payments during a shutdown “on a limited basis after a lapse of one week and continue through a short-term shutdown.”

Other loan programs deemed non-mandatory would continue for as long as possible depending on available funds and length of the shutdown.

The contingency plan states what programs would have to pause during a shutdown. These programs include most of its grantmaking activities, the Office for Civil Rights and most technical assistance unless “required for otherwise funded activities.”

“I think it would be extremely unfair for people who need that financial support and would be unable to get it,” said Caiden White, a Suffolk freshman. “If they pull back from financial aid, I think there would be a long-term decrease in skilled labor…because higher education is expensive, those who can’t afford that would most likely turn to unskilled labor like minimum wage jobs.”