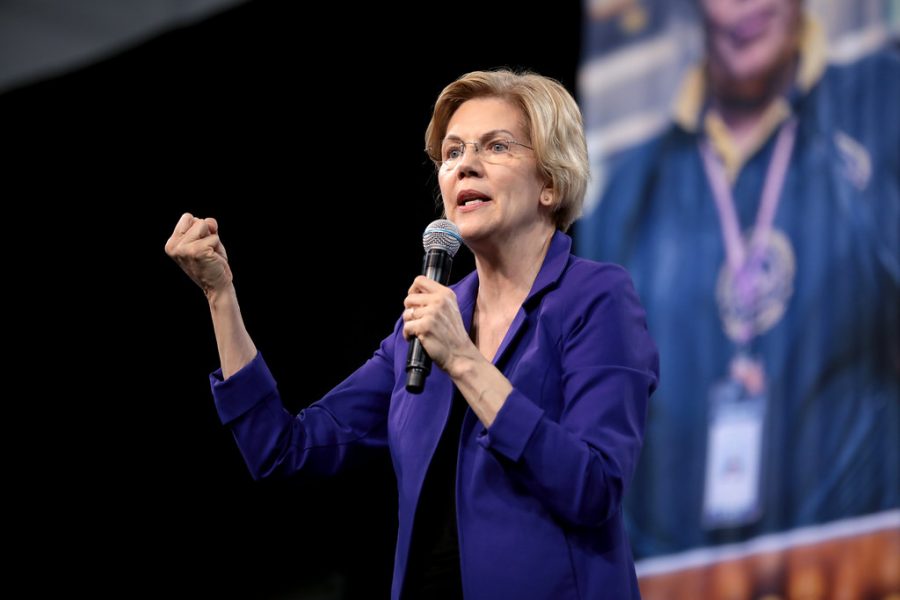

Sen. Elizabeth Warren’s plan to cancel student loan debt for more than 95% of borrowers was introduced as a bill in July, dividing people ahead of the presidential elections. Proposed by Warren in April and introduced as a bill in July, this plan has been highly controversial.

For decades, the cost of college has skyrocketed in the United States. The same is true for student loan debt, which is now about $30,000 for an average college graduate leaving school, up from $10,000 in the 1990s, according to CNBC.

To address this issue, Warren, a 2020 Democratic presidential candidate, proposed a plan for partial or total student loan cancellation, depending on a student’s household income. The plan calls for a 2% annual tax on families in the U.S. owning at least $50 million in net worth. Due to this tax, $50,000 worth of student loan debt will be totally canceled for students with a household income under $100,000, and partially for those with an income between $100,000 and $250,000.

Warren said 95% of borrowers will see some debt relief, and 75% will see their debt canceled entirely.

Some students and professionals think it is a huge relief for students with debt, while others consider it a big mistake.

For Madison Coolidge, a library employee and student studying film and media at Suffolk University, Warren’s plan will allow people to go further with their studies.

“I think a lot of young kids will agree with it. Many people stop [their formal education] after high school because they can’t afford it, or they don’t get enough scholarships or whatever,” Coolidge said.

While some people do not continue with school after high school, Yasky Valdez, a 28-year-old financial aid assistant at Suffolk University, said many go on to college anyways without being fully aware of how much debt they will accumulate.

“We don’t have the big picture of what it means to get into loans, and what that means after you graduate,” said Valdez. “We need more education [about] debt before entering college. In my case, I don’t think I’m going to be able to buy a house anytime soon.”

According to Warren, the amount of debt racked up during college is creating many economic and sociological problems that could be fixed by the plan. Supporters of the bill also do not only include those who have a lot of student debt.

“I didn’t pay for college because I got a scholarship, but the reason I got the scholarship is because my parents were able to invest ridiculous amounts of money, then me getting tutors, a really good education,” said Elling Williams, a senior account manager a the digital marketing company AdHawk in New York.

When students can’t rely on financial aid and scholarships and must take out loans to pay for college, Williams said this prevents them from taking financial risks after college and from stimulating the economy.

“If I had to pay for college by myself, I would have ended up with thousands of dollars in debt by the time I graduated, which would have meant that the risks I was able to take after college would have been impossible,” Williams said. “When people have the sort of safety to fail, it allows them to try more ambitious things.”

While some students like Williams were able to get through school with little debt, others gave up on their dream job to get a higher paying job that could help them pay back their loans.

“When I went to law school, I really intended on just having a job where I could cover my debts, said Ian Coghill, a staff attorney at the Conservation Law Foundation in Boston. “I had in my head that I might try to be a prosecutor or something like that, and then I found out that prosecutors in Boston are starting salaries at $33,000 a year. I was going to get out of law school with $200,000 in student loans. That was not going to work.”

People do not get paid high salaries in public interest work according to Coghill, which is preventing them from being able to have much of a life for 10 years after they graduate college.

“It’s a lot easier for people who have millions of dollars to pay nothing in taxes than it is for someone who makes $40,000 with two kids,” said Coghill.

While many have different opinions on the subject, most agree on one point: Warren will have a hard time putting the plan in place.

“I don’t think rich people are going to be like ‘yeah, sure, let’s forgive and, you know, pay all these debts,’” said Valdez.

Mariangel Feinberg • Nov 18, 2019 at 5:58 pm

We do not require much documents if you are interested in getting a loan. To apply contact us via the email address below Email: ([email protected] )