Election Day is just over a month away, and the presidential candidates are getting down to business and doing all they can to get the majority votes come November 6. President Obama, Governor Romney, and their Vice Presidential candidates are traveling all over the country and making appearances as frequently as possible with the debates looming over their heads. They are each trying to sway the public and, more specifically, the voters to earn support.

Obama and Romney are both giving their all to appeal to the different voter groups such as the elderly, Latin Americans, veterans, small business owners, middle class workers, and, possibly the most important, the youth and students in the United States. Considering they are the future, many political analysts are monitoring what impact, big or small, students will have on the race this year. The ever-present topic of improving the economy is the number one concern for most. But, for many students and young voters, the key issue at hand is college loans and the rising student debt crisis.

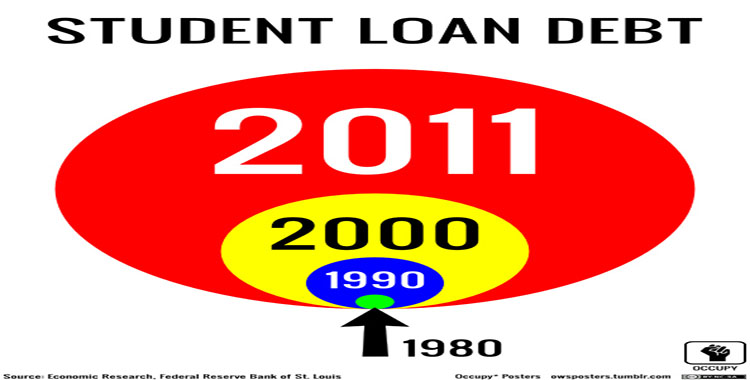

According to the nonpartisan Project Vote organization, even though they are “21 percent of the eligible voter population, voters 18-29 made up only 17 percent of the actual voting population in 2008.” In this election, they still have potential to actually be the deciding factor in whether Obama is reelected or Romney becomes our 45th president. It is obvious that they are the future of the country, so in reality one would think that what concerns them most would be a popular topic on the campaign trail. The amount of student loan debt in the United States passed the amount of total credit card debt last year and, just this summer, passed the $1 trillion mark. In such an unsteady economic situation, students are becoming more and more worried about knowing if they will ever be able to pay off their student loans.

Suffolk freshman and economics major Doug DellaPorta does not have any students loans because, unlike most people his age, he can simply afford tuition without them. DellaPorta says that, “student loans take advantage of students by exploiting their extreme need for a loan,” and that “they charge very high rates and really make students pay for the money they borrow.”

DellaPorta says, “it leaves students in desperate need for a loan and they’re forced to agree to the bank’s terms.” He realizes the huge advantage that he has over other students coming out of college.

In June, Congress voted to extend the just over three percent interest rate for student loans for another year. Although this can be considered progress, many students are still looking for more assistance with such a high fiscal burden. This was also why a vast majority of the Occupy Wall Street protesters were under 30-years-old. The movement had voice last year, but it is not certain if it will help shape a voice for the younger voters this year.

In terms of the candidates’ positions on student loan debt, they each have a plausible solution. Obama offers an ‘Education Calculator’ for parents and students to compare the advantages of his plan for improving the process. His website also criticizes Romney’s campaign by saying, “shop around, get a good price,” referring to Romney’s multiple plans.

Romney’s campaign website provides three plans for making higher education more affordable. He says, “Strengthen and simplify the financial aid system,” “welcome private sector participation instead of pushing it away,” and “replace burdensome regulation with innovation and competition.”

Both presidential candidates still have some time to share their message and ideas for a better America, but the younger voters have a chance to actually make a difference. The outcome will show what effect they have in the coming years. Student loan debt will keep increasing across the country, state by state, student by student, until someone does something to better the situation.

The Suffolk Journal • Sep 26, 2012 at 5:25 pm

Students owe most of anyone in U.S.: http://t.co/rc8NIBXn

Dougie DellaPorta • Sep 26, 2012 at 5:19 pm

RT @MilesH_CT: My article for this week’s issue of the @SuffolkJournal: http://t.co/hcM7L1qX via @SuffolkU_News #StudentLoanDebt #SuffolkJournal @Suffolk_U

Miles Halpine • Sep 26, 2012 at 4:38 pm

My article for this week’s issue of the @SuffolkJournal: http://t.co/hcM7L1qX via @SuffolkU_News #StudentLoanDebt #SuffolkJournal @Suffolk_U