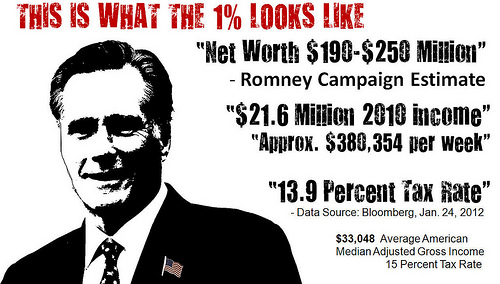

After increased pressure from his fellow Republican contenders, presidential candidate Mitt Romney has finally released his 2010 tax returns and an estimate for his 2011 returns. The more than 200 pages of documents reveal just how wealthy the ex-CEO of Bain Capital and former Massachusetts governor is—raking in approximately $45 million in income over the past two years and paying only $6.2 million in taxes.

In 2010, Romney paid a tax rate of about 14 percent ($3.2 million) on his multi-million dollar income ($20+ million)—about the same tax rate paid by middle-class American families that earned less than $70,000. Romney earns more in a day than the average American makes in a year, approximately $33,000 according to Bloomberg News. Additionally, Romney’s earnings in a week, about $380,000, equal the annual income threshold to be considered a part of the one percent of wealthiest Americans.

But while Romney admits that his tax returns will generate much discussion, he stands by them as “entirely legal and fair.” Really? A multi-millionaire paying a lower tax rate than many middle-class citizens, safekeeping money in tax-exempt offshore accounts is fair, and making money off of money rather than off labor is fair?

At a time when the middle class is shrinking, regular citizens who played by the rules are losing their jobs and homes, and big businesses are still paying out record bonuses to CEOs, it’s quite a stretch to call Romney’s tax rate fair.

Romney has called himself “unemployed” out on the stump at times, but the income off his capital gains and interest off his investments place him securely into the one percent. He pays almost nothing in payroll taxes and he makes what he calls “a nominal amount” in speaking fees (although most people would consider the $300,000 plus side income quite substantial). The returns also detail bank accounts in the Cayman Islands, a recently closed Swiss Bank account, and millions paid out in charitable contributions to the Mormon Church.

Ever since the birth of the Occupy Wall Street movement, income inequality has been at the forefront of America’s political discussions—becoming quite the headache for the extravagantly wealthy Romney. As a super rich candidate, Romney has switched back and forth from touting pride in his wealth as a success of American capitalism to attempting not recognize the disparity between his accomplishments and the economic plights of most middle-class citizens.

Romney’s excessive wealth and low tax rate highlight the wide gap between everyday Americans and the super rich, embodying the injustices that Occupiers have been protesting for months. As he continues to vie for the Republican nomination, Romney must try and connect with everyday Americans and prove that he is not another out of touch elitist—a feat that has been eluding his campaign all election season.

Romney’s tax burden is ‘fair’?!

Ally Thibault

•

February 7, 2012

2

0

Donate to The Suffolk Journal

$0

$1050

Contributed

Our Goal

Your donation will support the student journalists of Suffolk University. Your contribution will allow us to cover our annual website hosting costs.

More to Discover

Len • Aug 19, 2012 at 8:50 am

Romney’s tax burden is ‘fair’?! http://t.co/VPwmowVR

Len • Aug 18, 2012 at 4:32 pm

Romney’s tax burden is ‘fair’?! http://t.co/VPwmowVR… EARNS $33,000 A DAY