For many in America today, a diagnosis of Type 1 Diabetes (T1D) is a death sentence. Not because there aren’t any treatments available, But rather, because insulin, the “lifewater” for people with T1D, has become prohibitively expensive for so many.

Alec Raeshawn Smith was your average 26-year-old. He enjoyed camping, was a fan of the Minnesota Vikings, and just started a new job. He was also a Type 1 Diabetic. He relied on artificial insulin injections to regulate his blood sugar. Luckily, he was able to claim dependency under his mother’s insurance, receiving the insulin he needed for only $300 a month. But as he turned 26, he aged out of his mother’s insurance.

As reported by NPR on Sept. 1, 2018, his job didn’t offer insurance, and he earned too much to qualify for Medicaid. Alec couldn’t afford the $1,300 a month out-of-pocket it cost to refill his prescriptions. So, he resorted to rationing his insulin. Roughly a month later, Alec died of Diabetic ketoacidosis, just three days before his next payday, all because he could not afford his insulin.

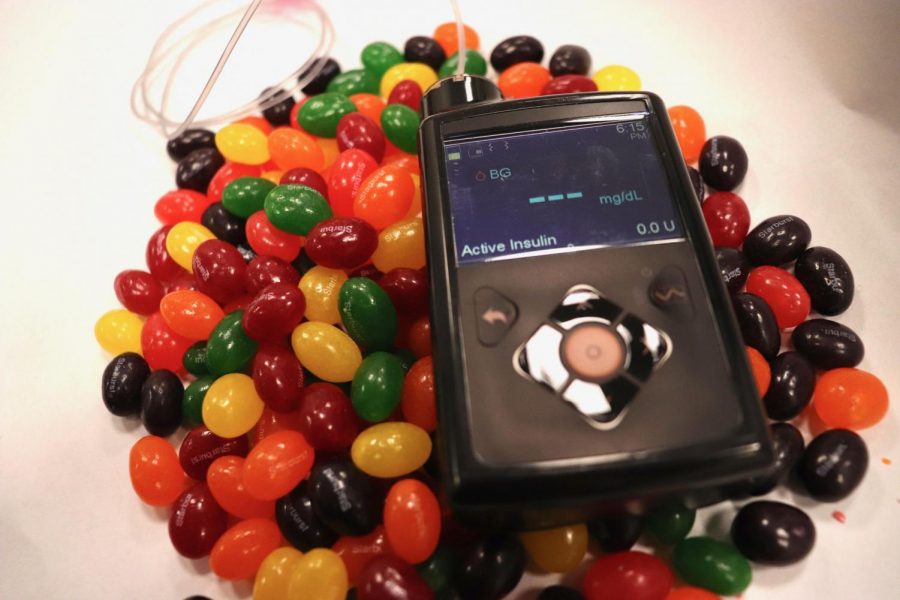

Diabetic ketoacidosis is a terrible way to die. Your blood turns to acid, and you fall into a diabetic coma as your organs start to shut down. I know this because I am a Type 1 Diabetic. And when I was diagnosed at the age of 14, I almost died from Diabetic ketoacidosis.

According to the American Diabetes Association, 30.3 million Americans depend on insulin to treat their diabetes, with one-in-four being unable to afford their insulin. Further, insulin is growing more unaffordable each year. The list price of insulin has tripled since 2002. Insulin is the seventh-most expensive liquid in the world, selling at a rate of $13,100 per gallon. A vial of Humalog insulin costs $435 on average to an American without insurance, but costs $37 in Canada.

Compounding this, three corporations, Eli Lilly, NovoNordisk and Sanofi, known as the “Big Three,” control the American insulin market. They have what amounts to a government-sanctioned oligopoly in the U.S. The Big Three have been widely accused of price fixing. There is currently a class action lawsuit making its way through the U.S. District Court of New Jersey, alleging that “The Big Three have not only dramatically increased their insulins’ benchmark prices in the last 10 years, but they have done so in perfect lock-step.”

To end this crisis, the U.S. Patent Office must revoke the Big Three’s insulin patents. This will allow other companies to use their formulas flooding the market with their own versions of insulin. In the 2018 case of Oil States v. Greene’s Energy, the U.S. Supreme Court held that the granting and re-examination of patents are public rights and aren’t subject to private property rights.

The Big Three maintain their stranglehold on the industry due to Patent Evergreening, and Pharmacy Benefit Managers (PBMs.)

Evergreening is the process by which drug manufacturers extend the life of their patents by up to 20 years at a time, simply by changing the ingredients in their drugs, even if they aren’t improving them at all, and applying for a secondary patent. According to the U.S. Food and Drug Administration (FDA), Sanofi has filed 74 secondary patent applications on its insulin alone, potentially granting them market exclusivity for 37 additional years.

PBMs keep drug prices high as they line their pockets with rebates from drug makers. PBMs negotiate between insurance companies and pharmacies, controlling which drugs end up on insurers’ lists of approved drugs, receiving rebates from drug makers to do so. The higher a drug’s list price, the higher the PBM rebate.

PBMs must pass on the value of the rebates they receive from drug makers to consumers. The Trump Administration is making moves to treat PBM rebates as illegal kickbacks for Medicare, Medicaid and private insurance. A proposal by the Trump Administration would take rebate prices and pass them onto patients as discounts. Such a move would incentivize PBMs to make decisions based on positive health outcomes to consumers, not merely rebates.

Dr. Frederick Banting was the first to synthesize artificial insulin in 1921. He sold the patent to the University of Toronto for $1, saying “insulin does not belong to me, it belongs to the world.” I would not be alive today were it not for his discovery. Tragically, Alex Raeshawn Smith died due to the greed of those who failed to heed the doctor’s words.

We dishonor the memories of Banting and Alex by continuing to support a system of insulin price gouging.

Our government failed Alex Raeshawn Smith. However, it is within our power to ensure that no diabetic, ever again, dies because they cannot afford the insulin they so desperately need.

Robert Reny • Dec 26, 2019 at 2:02 am

The continues increase in the price of insulin is costing patients about $15 per day. To tackle the situation diabetic patients in the United States are turning to the black market for medications and supplies. As their healthcare plan is failing to meet diabetic patient’s needs.

Source:- http://bit.ly/2EU8weM